Comprehensive Insurance Software Solutions Portfolio

Belitsoft’s insurance software development services cover the end-to-end creation of cloud-based applications for the insurance industry – from high-level architecture design to UI/UX, database schema design, workflows, and thorough testing. We deliver bespoke insurance software (web and mobile) tailored to optimize specific business processes such as underwriting, claims processing, policy administration, agent management, customer self-service, reporting, and regulatory compliance.

Insurance Automation Consulting. We guide insurers in streamlining and digitizing their processes.

Insurance System Implementation & Development. Full-cycle custom development of insurance platforms and applications.

Insurance Software Customization. Belitsoft adapts and extends off-the-shelf or legacy insurance systems to fit unique needs.

Insurance System Integration. Our developers integrate disparate systems and third-party APIs within the insurance ecosystem.

Who we are

IT software development company Belitsoft was founded in 2004. Since that time, we have been focusing on building and managing successful remote software engineering teams for each of our clients to develop enterprise-scale multi-user applications and elegant-yet-simple systems.

(August, 2024)

Belitsoft’s Expertise in Insurance Software Development

Belitsoft is a capable and credible provider of insurance software development services. We cover a full range – from consulting on insurance process automation to custom development, system integration, data analytics, and quality assurance – all tailored to the insurance industry’s needs.

Custom Insurance Software

For insurance organizations seeking a development partner, Belitsoft brings both the engineering capabilities and the industry-specific insight required to build modern, efficient insurance software solutions. Belitsoft reliably delivers complex insurance projects and contributes to the digital transformation of insurance businesses. We often work with existing insurance products or processes and enhances them, whether by adding new modules, connecting to other platforms, or rebuilding legacy systems for better performance. Clients ranging from startups and InsurTech firms to established insurance companies have trusted Belitsoft for solutions, including global insurance SaaS providers, Fortune-500 life insurers, and regional insurance businesses. The positive outcomes (significant cost savings, faster time-to-market, and improved system capabilities) demonstrate Belitsoft’s effectiveness in this domain.

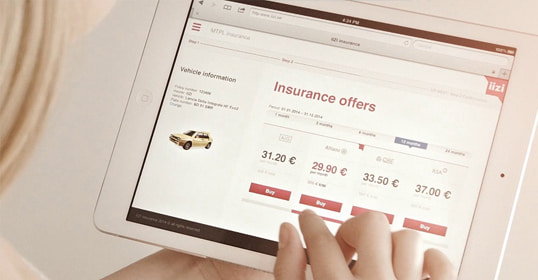

Customer Portals & Mobile Apps

Recognizing the importance of customer experience, Belitsoft develops insurance client portals and mobile applications for policyholders. These portals allow customers to view and manage their policies, request quotes, and initiate changes without needing to visit an office. A mobile app developed by Belitsoft lets users report claims online (after a car accident or home incident) through a guided, step-by-step interface. Such apps support uploading documents or photos (for example, uploading accident photos or scanned medical records directly from a phone). Other common features include real-time notifications (to update customers on claim status or policy renewals), integrated digital signature capture for paperless policy binding or claim forms, and GPS/geolocation services to help clients locate nearby approved service providers or assistance when traveling. These digital channels enhance customer self-service and satisfaction.

AI Chatbots and Virtual Assistants

Belitsoft also offers custom AI chatbot development for insurance companies. These chatbots use artificial intelligence to process customer inquiries about policies, provide instant insurance quotes, and assist users through the claims submission process. Deployed on websites or social media, the bots can help identify sales leads among visitors and answer questions in real time. These chatbots can integrate with core insurance systems (CRM, policy administration, etc.), so that they operate with up-to-date information and can initiate workflows. Belitsoft blends insurance knowledge with cutting-edge AI technology, aiming at improving customer engagement and operational efficiency.

API Integration & InsurTech Ecosystems

Belitsoft has strength in API development and systems integration for insurers. We build platforms that integrates agents, brokers, underwriting services, risk management tools, claims systems, repair vendors, fintech services, and AI providers via RESTful APIs. Belitsoft connects websites to offer embedded insurance quotes or purchases, or let broker partners get clients insured in seconds. Custom solutions use third-party data sources to enrich or cleanse customer data, improving accuracy in underwriting and claims. Belitsoft integrate online payment processing - policyholders can pay premiums or claim deductibles within an app. We offer integrations with legacy insurance platforms and cloud services.

Claims Management & Automation

Belitsoft has strong expertise in insurance claims processing systems. Custom claims management software aims to eliminate paper-based workflows and reduce the number of systems adjusters must use. Belitsoft builds solutions with a configurable claims intake process: using built-in form builders, insurance staff can design custom claim forms for different scenarios (accessible on web or mobile) without coding. Workflow automation is a key focus – the systems allow non-IT users to create drag-and-drop workflows for claims handling, minimizing dependence on IT teams. Belitsoft also implements rules-driven claims auto-adjudication and fraud flagging. Claims can be automatically assigned to appropriate team members based on predefined criteria, and rules engines can auto-approve or deny claims (based on coverage limits or claimant eligibility, etc.). All automated flows meet insurance regulations, speed up claim resolution and reduce human error in claims processing.

Data Analytics & Fraud Detection

In addition to transactional systems, Belitsoft has experience building analytics-driven insurance solutions. We work on platforms that analyze large datasets of claims and customer information to detect patterns – systems that flag potentially fraudulent claims by cross-referencing claims data with historical databases and external sources. Our developers implement predictive models that score incoming claims on fraud likelihood, enabling insurers to prioritize investigations on high-risk cases. Belitsoft’s engineers are adept with technologies like Python (for data analysis) and .NET, and use machine learning techniques to convert business problems (like fraud or customer churn) into actionable analytics solutions. We also build risk intelligence dashboards that aggregate data and provide insights for decision-makers. Belitsoft helps create financial modeling frameworks and data-rich platforms that insurers use to model catastrophic event losses and agricultural insurance risks.

Underwriting & Risk Management

Belitsoft builds software to accelerate underwriting and improve risk assessment. Our solutions can reduce policy underwriting time from days to hours by automating rule-based decisions and event analysis. Belitsoft helps develop catastrophe risk modeling platforms for insurance analytics providers, enabling insurers to evaluate losses from extreme events (like natural disasters) in the property insurance market. We also create agricultural risk modeling solutions to predict crop insurance losses by factoring in climate, crop genetics, yields, prices, and policy conditions. These underwriting and risk tools ingest data from multiple sources via APIs, allowing underwriters to make quick, informed decisions with real-time data integration. The systems are designed to be flexible, so insurers can update underwriting rules easily to align with new business goals or regulatory changes.

Policy Administration

Belitsoft develops policy management systems to help insurers administer life and P&C insurance policies. Features include unified policy dashboards with search, automated annual policy reviews, and real-time data sync between the policy admin system and customer applications. Custom policy administration software has premium calculation engines, tax and commission calculations, and an embedded underwriting rules engine to automatically compute premiums and enforce underwriting guidelines. Data validation and compliance checks are built in – the software can trigger warnings or notifications if a policyholder’s input violates compliance rules. These solutions also support document generation (policy documents, etc.) and follow industry standards like ACORD for data formats, being compatible with other insurance systems.

Notable Clients and Case Studies in Insurance

In addition to Microsoft technologies, Belitsoft has expertise in other backend technologies for certain insurance solutions. We are flexible in using different tech stacks depending on the project context. We work with Python/Django and other languages for specific needs (like back-end data processing in insurance databases). Our team has experience refactoring an insurance SaaS platform into a microservices architecture.

Technical Expertise and Platforms

On the back end, we frequently use Microsoft .NET and C# for insurance software development – many insurance solutions (especially in enterprise settings) are built on ASP.NET Core/Web API with SQL databases, and Belitsoft’s team has deep expertise in this stack.

Our .NET developers are versed in building scalable, secure systems (like claims management and fraud detection platforms) that comply with industry regulations and can integrate with other services via RESTful APIs.

We also implement rigorous automated unit and integration testing in these projects to ensure reliability.

In front-end development, Belitsoft works with modern JavaScript frameworks like Angular and React to create responsive, user-friendly interfaces for insurance applications.

We have experience with mobile app development as well (including native iOS/Android and cross-platform frameworks like MAUI/Xamarin or React Native), required for insurance mobile apps and adjuster tools.

On the cloud side, Belitsoft is proficient with Microsoft Azure. We also deploy solutions to Amazon Web Services (AWS) infrastructure when required, designing cloud-native components that are scalable and fault-tolerant.

Recommended posts

Our Clients' Feedback

.jpg)

We have been working for over 10 years and they have become our long-term technology partner. Any software development, programming, or design needs we have had, Belitsoft company has always been able to handle this for us.

Founder from ZensAI (Microsoft)/ formerly Elearningforce